Changes in the Price Level Meaning - the Federal Reserve Bank of Philadelphia

CHANGES IN THE PRICE LEVEL: MEANING - THE FEDERAL RESERVE BANK OF PHILADELPHIA Changes in Purchasing Power of Dollar Business fluctuations are usually accompanied by changes in prices. The "basket" of goods a dollar would buy has varied widely and each change brought a redistribution of income which worked a hardship on some groups. The chart shows wholesale prices from 1808 to 1949. The fact which stands out most clearly is the price peaks which accompany wars. Fluctuations in the purchasing power of the dollar are not limited to war periods, however.

From 1808 to 1814, in part because of the War of 1812, the amount of goods a dollar would buy dropped 39 per cent. From 1815 to 1834, prices dropped sharply and the purchasing power of the dollar more than doubled. The Civil War, which was financed partly by the issue of paper money, brought another sharp rise in prices, and the amount of goods that a dollar would buy dropped 70 per cent. Following the Civil War, prices dropped and the buying power of the dollar nearly doubled by 1879. World War I brought another sharp decrease in the buying power of the dollar, but during the depressions of 1921-1922 and 1930-1933 the value of the dollar increased substantially. Again, during and following World War II, prices rose sharply and the buying power of the dollar declined.

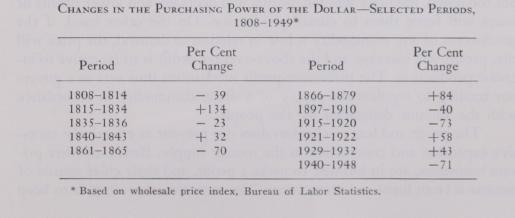

Some of the more important changes in the purchasing power of money are given in the accompanying table.

Why has the buying power of the dollar been so unstable? A short, simple answer to this question is not possible; but the various forces work through the flow of spending in relation to the flow of goods. If the money flow expands, demand increases and the tendency is to increase production and the flow of goods available for purchase. But as full employment is reached production cannot increase, prices rise, and a dollar buys less. Conversely, if the money flow becomes too small in relation to the flow of goods, prices fall and the dollar buys more. If money is to have a stable value and contribute to economic stability, one requirement is that the money flow and the goods flow be kept in proper relation to each other. The flow of goods is determined basically by the amount and qual

ity of productive resources and the use millions of independent producers decide to make of them in view of market conditions. The flow of money represents the combined effects of the volume of money in the hands of the public and how rapidly it is spent.

Despite the fact that the supply of money has an important influence on prices and the volume of production, there was no central agency before the Federal Reserve System which could exert any influence over total deposit expansion and contraction. Periods of business expansion were accompanied by an increase in bank loans and the money supply, and also by a rise in prices. The boom usually continued with increased momentum until something like inability to get more credit or loss of confidence brought it to a halt. Then there usually followed a period of contraction —in production, prices, and bank credit. Although not the only factor, an excessive expansion and contraction of bank credit and the money supply contributed to these wide fluctuations in prices and the volume of business activity.