Economic Fluctuations a Later View

This is the dilemma confronting any economy that has not developed an adequate anti-cyclical program. Boom levels of private investment outlays are not maintainable over the long run. Without an anti-cyclical program the inevitable collapse in investment will induce a magnified fall in income, and this in turn will induce a further fall in investment in a cumulative fashion until eventually the internal stabilizing factors come into play.

Unmaintainable Spurt in Capital Formation

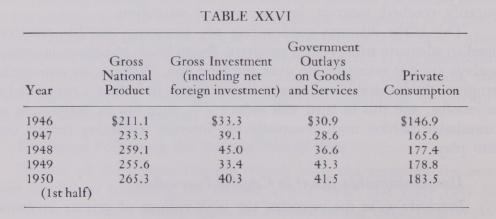

Precisely as in the twenties, the high volume of private investment outlays in 1947-50 represented an unmaintainable spurt in capital formation. The war left accumulated arrears in commercial structures, houses, and producers' equipment. These "deferred demands" largely account for the wave of investment which carried gross private domestic capital formation up to $45 billion in 1948.

Starting from 1946, the first full peacetime year following the Second World War, the United States has experienced a great postwar restocking boom. In some respects this boom resembles that of 1919-20, but there are a great many dissimilarities. Comparison might also be made with the prolonged boom of the twenties, but here again we would find a number of striking differences.

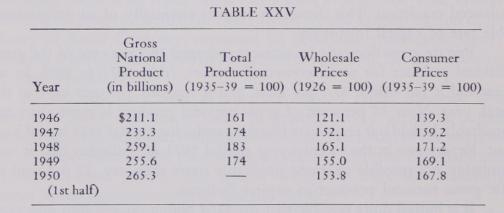

Table XXV gives data on gross national product, production, and prices for the years 1946-50, inclusive. A considerable price rise occurred in the eighteen months from July, 1946, to January, 1948, after which prices substantially flattened out. Total production rose significantly from 1946 to 1948, owing mainly to the progressive elimination of bottlenecks and the filling of "pipe lines" in areas in which materials were in short supply. The substantial rise in gross national product was compounded partly of increases in total production, but much more largely of price increases.

The component parts of the gross national product for are shown in Table XXVI.

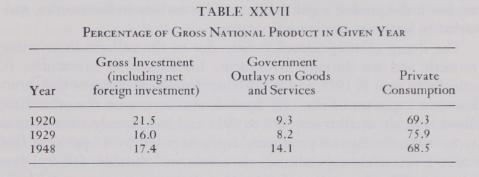

In order to make significant comparisons with the booms culminating in 1920 and in 1929, it will be useful to compare the relative importance of these components in the gross national product for each of the three years 1920, 1929, and 1948. These data are presented in Table XXVII.

Three Booms Compared

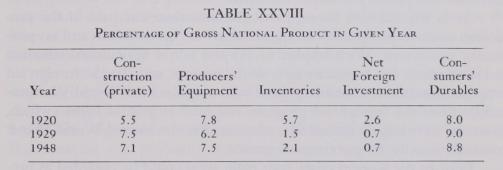

The 1920 boom was characterized by an extraordinary spurt of investment, considerably greater, relative to gross national product, than the investment of either 1929 or 1948. In order to obtain a clearer pictureof the role of investment in each of the three booms, let us break up investment into its component parts—construction, equipment, inventories, net foreign investment—for each of the three periods. Table XXVIII gives the percentage of gross national product expended on each of these investment categories. The percentage of gross national product spent on consumers' durables for each period is also added.

The years 1929 and 1948 are strikingly similar, except that somewhat more, relatively, was spent on producers' equipment and inventories in 1948. The relative amounts spent on total fixed capital (construction plus equipment) were very similar for the two years. Also the role of consumers' durables was nearly the same in 1948 as in 1929.

Following the First World War (1920) the proportion of the gross national product going into private construction was somewhat less than that in 1948, while in the case of producers' equipment the proportions were very similar for the two years. But with respect to inventory accumulation and net foreign investment the year 1920 presents a strikingly different picture from that of 1929 and 1948. Both these items were fantastically large in 1920, and it is here that one must find the reason for the phenomenally large proportion of gross national product going into investment in this postwar spurt. The 1920 boom did not present a disproportionate investment in fixed capital compared with other high boom years; but it did present a quite abnormal investment in inventories, and a remarkably large net foreign investment.

The slump of 1921-22 was mainly due to the collapse in inventory investment and net foreign investment. Investment in inventories fell practically to zero in 1921, and by 1922 net foreign investment had shrunk to less than a quarter of the 1920 level. Construction, on the other hand, declined scarcely at all from 1920 to 1921 and had already risen substantially by 1922. Outlays on producers' equipment fell by 45 per cent from the 1920 level, while expenditures on consumers' durables fell by about 20 per cent. The depression of 1921-22 was due in great part to the inventory situation and the adverse change in the net foreign balance.