The Incidence of the Tax Structure

THE INCIDENCE OF THE TAX STRUCTURE by Richard A. Musgrave The incidence of taxation and the effects of taxation on consumption are closely related. In order to appraise the latter, we must know something about the former. At the same time, they pose distinct policy problems. The determination of who should pay the taxes and the equitable distribution of the tax bill is one important consideration of tax policy. The choice between taxes which fall on consumption and taxes which do not is another consideration, involving a quite different set of factors. In some cases, the two will support each other, and in others they will conflict.

Who pays the taxes?

I begin with my first topic, who pays the taxes. We have prepared in this connection a revision of our earlier estimates of tax burden distribution for the year 1948. While there have been no drastic changes in tax structure, the great increase in income since that time has rendered the earlier figures of little use for present purposes. The methods followed are more or less similar to those of the earlier study. While the calculations were made in less detail, some of the criticisms of the earlier study were taken into account.

Results Of Study

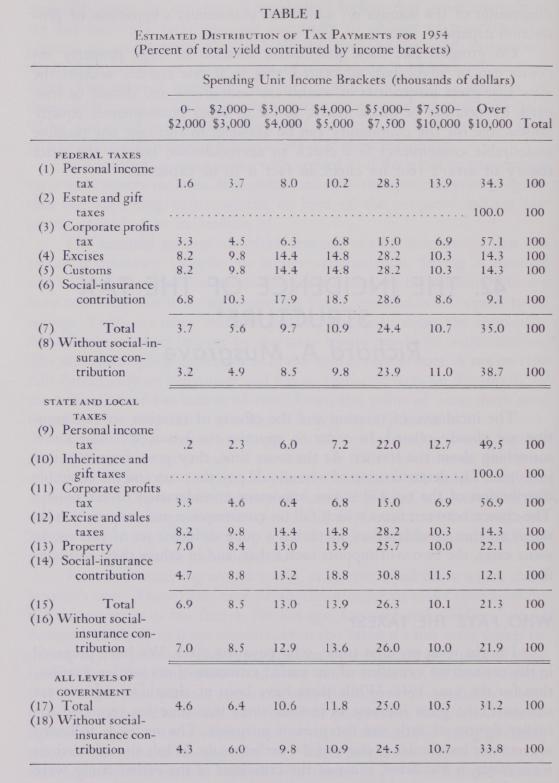

1. Overall Picture . . . The results are summarized in table 1 which shows the percentage distribution of taxpayments by spending unit income brackets.

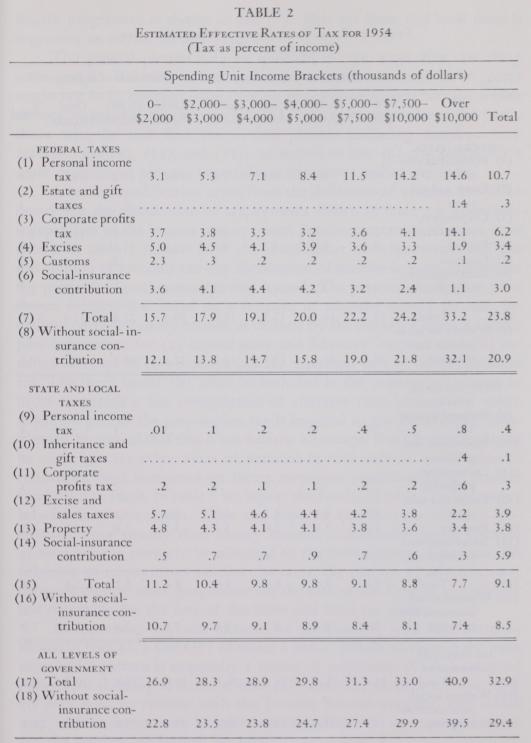

The data are for 1954 and both the Federal and the State and local tax structures are covered. In table 2 we show the so-called effective rates of tax, that is, the ratio of taxpayments to income received for the various income brackets. It is this ratio which we look upon to determine whether the tax structure is regressive or progressive, and by how much.

The estimated incidence of the total tax structure, including all levels of government and all taxes, is shown in line (17). We find that the incidence is progressive throughout the scale, although the degree of progression appears to be quite moderate over the lower and middle income ranges. The picture for the Federal tax structure alone is more distinctly progressive as shown in line (7). That for State and local taxes is regressive as shown in line (15).

The general picture may be qualified in two ways. For one thing some people feel that social insurance contributions (all or in part) ought not to be counted since they go to purchase special benefits which are not included in the picture. While I don't quite subscribe to this view, those who do will find the overall picture excluding social-security taxes in lines (8), (16), and (18). As shown in line (8) this makes for a more progressive picture, especially at the lower end of the scale.

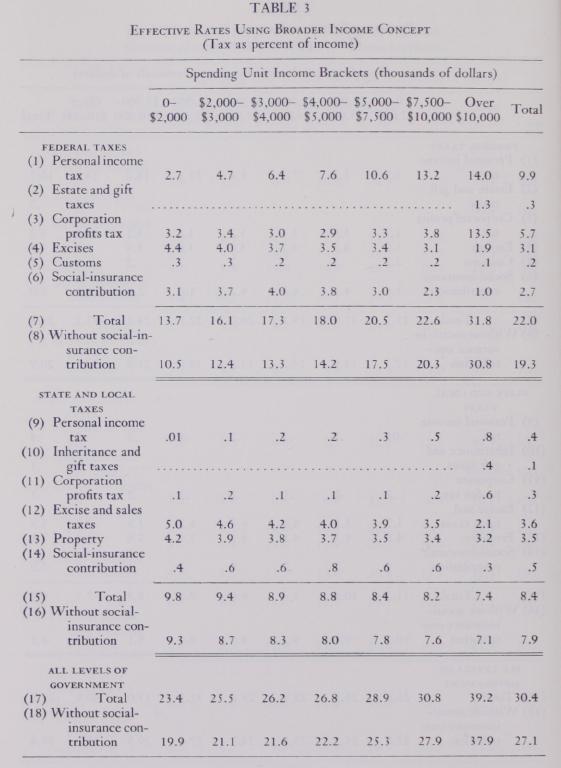

A second qualification arises from the definition of income. It will be noted that the distribution of taxpayments shown in table 1 is essentially independent of the income concept used. But the pattern of effective rates shown in table 2 reflects both the distribution of taxpayments and the distribution of income; and the distribution of income in turn depends on the particular income concept that is used. The pattern of effective rates shown in table 2 is based on a concept of adjusted money income, including outright money income as defined by the Survey Research Center plus imputations for (a) capital gains and fiduciary incomes, and (b) retained earnings of corporations and the unshifted part of the corporation tax. The items under (b) must be included in the concept of income in order to permit a fair computation of effective rates because the entire unshifted part of the corporation tax is imputed to the shareholder. Now it might be argued that this is too narrow a concept, that allowance should be made also for other items of imputed income such as rental value of residences, food consumed on farms, employer contributions to pension funds, and so forth. In table 3 we repeat the results of table 2, using such a broader income concept. Since the imputed income thus added is distributed more equally than money income, a somewhat larger fraction of total income comes to be allocated to the lower groups. Since the distribution of taxpayments remains the same, the pattern of effective rates becomes slightly more progressive for the case of the Federal and slightly less regressive for the case of the State and local tax system.