The Cash Budget - the Public Economy

THE CASH BUDGET - THE PUBLIC ECONOMY by Paul Studenski and Herman E. Krooss Introduction of a Cash Budget The influence of Federal finance on the economy is exerted most immediately through the Treasury's cash transactions with the public. Any excess of Treasury cash receipts over cash payments reduces the disposable income of the population and tends to depress private employment, while any excess of Treasury payments over receipts tends to have the opposite effect. Traditional budget accounts do not give an accurate picture of all the Federal government's cash transactions with the public and therefore do not reflect the impact of Federal finance on the economy. Since budget accounts deal only with general and special fund receipts and disbursements, they omit the cash transactions of the trust funds (old age, railroad retirement, unemployment, etc.) with the public, but they include transfer payments between the general fund and the trust funds even though these have little effect on the public. In addition, some of the disbursements in the budget accounts, for example, interest on savings bonds, are mere accruals and involve no actual cash payments. The divergence between the budget accounts and the cash transactions with the public first became important in the middle thirties. It grew wider as the size of the trust funds increased. The exclusion of trust-fund transactions from the budget accounts in 1933, instead of alleviating, accentuated the confusion.

The need for annual or more frequent statements of cash transactions with the public became clear during World War II when it was realized that the inflationary effects of increased governmental fiscal operations were determined by the excess of governmental cash payments to the public and not by the excess of budgetary expenditures over budgetary receipts. Since the government economic and fiscal policy could not be formulated most efficiently by reference to budget accounts, the Treasury started to prepare more comprehensive cash accounts.

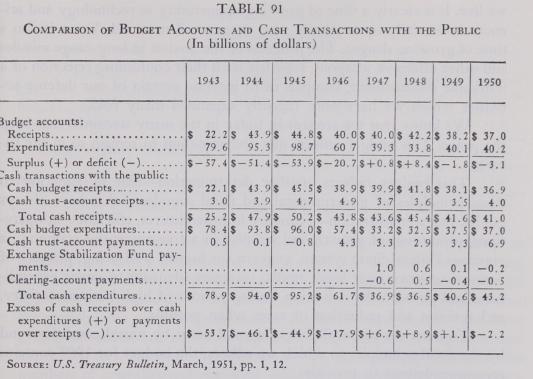

Table 91 shows the difference between budget accounts and cash accounts. It will be noted that for 1947 the budget accounts showed a surplus of only $0.8 billion, but the surplus of Treasury cash receipts over cash payments was $6.7 billion. In other words, the Treasury's fiscal operations during that year were much more deflationary than indicated by budget accounts. For 1949 the budget showed a deficit of $1.8 billion, but since cash accounts showed a deficit of only $1.1 billion, the inflationary influence of government finances was somewhat smaller than suggested by the budget accounts.