World Bank

WORLD BANK by The International Bank for Reconstruction and Development The Bank's Lending The Bank opened its doors, nearly a year after the end of the war, on a world still in crisis. The peace had not been secured: alarms of war were, in fact, to persist throughout the decade. An international program for the relief and rehabilitation of war-devastated countries was coming to an end and, while massive United States aid was being provided, it was not certain how much longer this aid would continue. Crops had failed in some of the major producing areas of Europe; simultaneous demands for large food imports and for fuel, materials and equipment to reconstruct Europe's economy were depleting foreign exchange reserves at a steadily increasing rate.

There was no question of meeting these needs by private international investment. The Bank itself also had to lend. Yet it could not lend hastily, for in 1946, it was watching the deepening international economic crisis with less than $700 million of usable funds in sight. It had no earnings, no reserves, and for that matter, no operating experience as an institution. It had not tested its ability to raise capital by borrowing; and the price it would have to pay in the United States market, which for some years would have to be almost its only source of borrowed funds, was unknown.

The Reconstruction Loans The Bank, nevertheless, had been established to take risks. From May into August 1947, it made $497 million of reconstruction loans in four countries of western Europe: France, the Netherlands, Denmark and Luxembourg. These funds were an important supplement to the resources of the borrowing countries. The Danish loan, for instance, amounted to 9% of net investment in Denmark in 1947 and 1948, and the Dutch loan amounted to 15% of net investment during the same years. And the timing was crucial: coming from seven months to a year before the Marshall Plan, they helped maintain a flow of essential imports when an interruption would have been a serious setback to European recovery.

Bank Lending 1948-1955

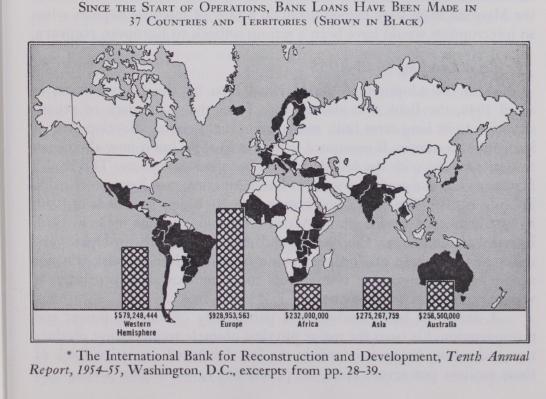

With the adoption of the Marshall Plan by the United States in April 1948, the Bank was able to turn from the emergency of reconstruction to its long-term task: assistance in the economic development of its member countries. It continued to lend in Europe, but it now also beganto deal actively with the less developed countries elsewhere. The Bank's first loans in these countries were in Latin America; two loans were made in Chile in 1948. The Bank's first loan in Asia (to India) was made in 1949; its first loans to Australia and in Africa (to Ethiopia) were made in 1950. In most of these areas, the Bank found itself faced with problems very different from those of European reconstruction. Here the task was not simply to restore missing components to economics already mature; it was to strengthen foundations.

A dearth of basic services, and particularly of electric power and transportation, has been the major physical obstacle to increasing production and raising living standards in the less developed countries. Lack of these services put severe limits on productivity, on income, and on the willingness to invest. Deficiencies of electric power supply were conspicuously handicapping industrial growth. The lack of dependable and economical transportation had restricted the size of markets for both industrial and agricultural production, and had kept regions with promising natural resources beyond the reach of development.

To strengthen basic services and so to set free new productive energies has been the main objective of the Bank's development lending. The Bank has made more development loans to develop electric power than for any other purpose; but it has lent nearly as much for highways, railways, ports and other means of transporation. Taken together, power and transportation account for two-thirds of the Bank's development lending. Projects in these fields have plainly met the Bank's tests of usefulness and urgency; and in general private capital has not been available for projects of this type, even when they were revenue-producing.