World Bank

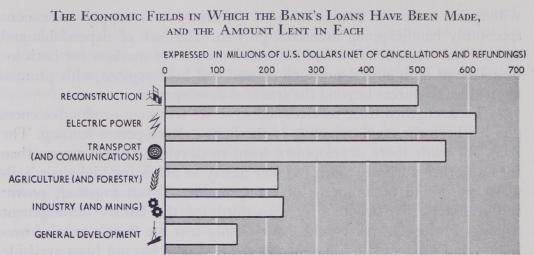

About one-eighth of the Bank's development lending has been directly for agriculture, another field of clear priority. The Bank has lent for agricultural machinery, for the equipment needed in land reclamation, irrigation and flood control schemes, and for the expansion of agricultural credit. And the expansion of agricultural production has been an important objective of loans made in other fields, especially for power and the improvement of transport services.

Industry also has been a major beneficiary of the loans for power, and about one-eighth of the Bank's post-reconstruction lending has been more directly for industry. Most of this lending has been in countries around the periphery of Europe; the Bank has also made loans for the private production of iron and steel in India, of pulp and paper products in Chile and of cement in Peru.

In general, however, more private capital has been available for industrial expansion than for investment in basic services, and to supplement private investment in industry has presented the Bank with certain problems. In underdeveloped areas, industry often develops through a variety of small projects; and it is extremely difficult for the Bank to assess the economic merits and feasibility of these enterprises. Another difficulty arises from the requirement of the Articles that loans to private borrowers must carry a governmental guarantee. This requirement has discouraged private borrowers, who often fear that a government guarantee might lead to state interference in their business. Governments, on the other hand, have usually been reluctant to give their guarantee lest they appear to favor one private enterprise over another, or over various public projects.

In some cases, the Bank has been able to surmount these obstacles by making funds available to industry through intermediary institutions. In Ethiopia, India and Turkey, moreover, it has helped to establish, as well as to finance, new credit institutions able to investigate projects on the spot and to lend without guarantee, chiefly for industrial development.

And the Bank's member countries are now taking steps to create an affiliate of the Bank, the International Finance Corporation, to invest in private enterprises without government guarantee and to make not only fixed interest loans but more flexible types of investment.

Convenient though it may be to describe loans according to economic sectors, economic development obviously does not take place in compartments. The Bank lends with a view to the economy of a country as a whole. In most countries where it has lent, it has lent more than once, has lent for various purposes, and often has lent for projects that complement each other.

In Iceland, for example, two loans have been made for imported materials to improve farm buildings and pastures; another has been made for a plant to produce fertilizer which will be used to extend pasture land and improve the yield of grass; and this plant will draw its power supply from a hydroelectric project for which still another loan has been made. In India, one of the regions to benefit from a loan to improve the service of the national railways was the industrial Damodar Valley; another loan is helping to expand the private production of iron and steel in the Valley; another will help to provide power for various industries; and yet another is being devoted to multipurpose projects which will benefit both industry and agriculture there. In Nicaragua, loans have been made for tractors to increase agricultural yields, for roads to improve transportation between producing areas and markets, for a plant to store grain, and for power stations to supply local industries, many of which process domestic agricultural products.

The most typical pattern of lending has been and will continue to be a series of single loans, made over a period of time, to finance imports for a variety of single projects. In some cases, however, a loan has in fact financed a program, embracing projects in different economic sectorsó as, for instance, in the case of loans made to Yugoslavia in 1951 and 1953. In other cases, as in the example of the loan made this year to Norway, the Bank has not lent for particular imports or particular projects, but has provided the foreign exchange needed for general development. In developed areas where the necessary capital equipment is locally available, the Bank has lent foreign exchange to cover domestic expenditures, as in loans this year to Austria and Italy.