Income Tax in Practice

INCOME TAX: IN PRACTICE. War provides a fertile soil for the roots of taxation. Perhaps the earliest income tax in England is to be found in the old land tax. After the Revolution the war with France led to a considerable sum of revenue being raised on the land. The land tax imposed in 1692 continued to draw supplies from this source, but in addition it imposed a tax of "4 sh. in the f according to the true yearly value" of any "estate in goods, wares, merchandise, or other chattels, or personal estate whatsoever within this realm." In addition, it imposed a similar tax upon the profits and salaries of all persons having any office or employment of profit, except naval and military officers. It is not known how the duty on personal estate was levied, or what was its proportion in the quotas of the total land tax raised. All that is known is that over the course of years the yield of the tax on personalty dwindled almost to nothing.

Pitt's Income Tax, 1799.

A century later the financial neces sities of the further wars with France, the Napoleonic Wars, led to the return to the income tax as a financial instrument. Ignoring an attempt to link the old assessed taxes on carriages, horses, men servants, etc., to the amount of the taxpayer's income in the form of duties, which were called the "triple assessment," a regular income tax was imposed in Great Britain in 1799 by William Pitt. The taxpayer was asked to state his income from all sources but incomes under 16o were exempt. The general rate of tax was which was applied to all incomes of f 20o and upwards. For incomes between f 6o and f 200 the rate was graduated, while cer tain deductions were allowed for children and repairs to property. Some of these refinements of taxation proved, however, to be before their time. Abused by the taxpayer they were erased from the statute book and revived only in modern times. After the Treaty of Amiens in May 1802 this early statute was repealed.When war was resumed in 1803 a new income tax act was en acted, framed on lines which were so soundly based as to remain, in essence, the framework of the modern law. Not only were the sources of income divided into the five great classes which remain with us to-day as schedules A, B, C, D and E, but the principle of collection of the tax at the source was introduced. The former statements of total income were abandoned ; in their place were required statements of income from particular sources. So potent was the new principle of collection at the source that the yield of the tax, notwithstanding the reduction of the rate from the io% of 1799 to a rate of 5%, was almost equal to that under the earlier act. During the century and a quarter that has since elapsed, this principle has continued to be the mainstay of the productivity of the tax.

Peel's Income Tax, 1842.

Af ter Waterloo the tax was re pealed, but it was revived again by Sir Robert Peel in 1842 as part of his scheme of the reorganization of the national finances. Peel's act of 1842 levied the duties under the five familiar sched ules, and the tax in its general structure, principles and scheme of administration closely resembled Pitt's act of 1803 as modified by an act of i8o6, in which the deductions for children and the allowances in respect of repairs to property were withdrawn.Apart from the exclusion of Ireland from the scope of the tax, an omission which was rectified in 1857, the tax as set out in Peel's act was not seriously modified until quite modern times. In 1842 the exemption limit was raised to 1 15o, but when in 1853 the tax was made effective throughout the United Kingdom it was re duced to L1oo. In 1876 the old limit of £i5o was restored and increased in 1894 to f i 6o, at which figure it remained until the outbreak of the World War led to its reduction in 1915 to f 130. The rate of tax has varied greatly. At the date of its repeal in 1815 it was 2S. in the pound. In the second half of the 19th century its general level may be said to have been from 6d. to 8d., although it was as low as 2d. in 1874 and 1875. The South African War brought the rate beyond the one shilling mark, while the World War pushed it up to a maximum of six shillings. Ten years of peace have brought it back to four shillings.

Graduation.

Graduation in some degree or other has almost always been a characteristic of the tax. During its earlier years it was of little effect, inasmuch as its application was restricted to the lower incomes, more or less as a practical necessity. A pro posal to extend it to the higher incomes evoked from Lord Brougham the opinion that such a system would be a gross and revolting absurdity. Harcourt in 1894 effected a slight extension of the graduation but he could not be induced to proceed beyond incomes of f Soo. A similar attitude was adopted throughout the 19th century towards the principle of differentiation, that is, the principle of charging earned income at a lower rate than that applied to investment income. Select committees in 1851 and 1861 were hopelessly divided in their views upon this method of relief. It was left to Asquith to appoint the select committee of 1906 to consider the practicability of both graduation and dif ferentiation. Upon the recommendations of this committee both principles found a final acceptance.

Graduation and Differentiation, 1907.

The Finance Act of 1907 gave earned income in the enjoyment of a taxpayer whose total income did not exceed £2,00o immediate relief of one-quarter of the normal rate of one shilling. Later acts have so refined upon the principle that it is now firmly embedded in the British income tax system. The principle of graduation came into its own in the same act of 1907 through the introduction of a super-tax upon incomes over £5,000, which was imposed as an additional tax of 6d. in the f on the amount by which the income exceeded f 3,000. Here also later acts have changed the weight and range of the graduation but have left the principle inviolate.In 1918 all the numerous income tax enactments were con solidated into one statute in the Income Tax Act, 1918, which came into force on April 6, 1919. A comprehensive examination of the whole income tax system was conducted by the Royal Commission on the Income Tax in 192o. Following its recom mendations changes were made in the method of granting the differentiation relief and in applying the principle of graduation. The relief introduced in 1916 in respect of double taxation, so far as it arose from dominion income taxes, was put upon a permanent footing. The commission also made recommendations in a number of minor matters, some of which have been duly incorporated into the law and others of which, including a resolute attempt to deal with the evils of evasion, still remain to be fully implemented.

The British tax has been developed gradually in detail, reflecting at various stages in its history the growth of opinion, equality and justice, until to-day it is a financial instrument of great intricacy, subtlety and power. None the less the broad scheme of the law has remained unchanged in many essential characteristics for nearly a century. Flexibility is provided by the annual re-enact ment of the whole income tax code through the medium of the continuation clauses in the yearly Finance Act, which serves also as the medium for amendments, extensions and declarations of the construction of the law.

The salient characteristics of the tax may be grouped under nine heads.

Scope.

The tax extends, broadly speaking, to all income aris ing in the United Kingdom by whomsoever it may be enjoyed, and to all income accruing to persons residing in the United Kingdom without regard to the place where it may arise. The tax walks, so to speak, upon the two legs of origin and residence. It therefore leads to the problems of double taxation. Provisions for relief against this defect, resting upon the principle of division of the total tax between the two taxing jurisdictions, exist as respects income liable both to United Kingdom tax and tax in any of the British dominions overseas, except in the case of the Irish Free State, where the relief is based upon the principle of charging tax only in the country of residence. Further provisions for double taxation relief also exist as respects profits on shipping. One code of laws applies, generally speaking, to individuals, part nerships, companies and other bodies of persons. In the main the tax is a tax on the incomes of individuals, nearly 9o% of the total actual income brought into charge being distributed among indi viduals who are actually resident in the United Kingdom.Administratively, the tax is levied under five separate categories or schedules of income. But this is a matter of machinery only, and the tax borne by individuals is in reality only one tax on the total income of the individual, and not, as is often thought, a series of taxes on the separate sources of his income.

Definition of Income.

In respect of the ownership of lands, houses, etc., in the United Kingdom (schedule A) the measure of income is the annual value, which means broadly the rent at which the property is let, or is worth to be let by the year (the tenant bearing his usual rates and taxes), less certain statutory deductions for repairs. Relief may also be obtained on an average cost of additional expenditure on repairs, maintenance, insur ance and management. Annual value is determined periodically.In respect of the profits on occupation of land in the United Kingdom (schedule B), the measure of profit is made on a con ventional basis, which assumes profits bearing, in the case of land used mainly for the purposes of husbandry, a fixed relation of equality to the annual value of the land occupied. In other cases it is a relation of one-third of the annual value.

No definition is necessary in the case of interest on public funds (schedule C). Income (schedule D) from dominion and foreign securities (other than public debts) or from foreign and dominion stocks, shares and rents is normally liable on the full amount of the income, less charges which must necessarily be met abroad.

There remain the two main classes : income from trades or pro fessions (schedule D) and income from employments (schedule E). Here the broad rule is that the income to be charged is the excess of the gross receipts over the expenses incurred wholly, necessarily and exclusively in earning the profits or income in question.

The British income tax, in the words of one of the judges, "is a tax on income," and this is strictly construed by the exclusion from the scope of the tax of profits which are in the nature of capital gains; in this respect the British system is strikingly dif ferent from that in force in the United States of America. In consequence, the law prohibits, in arriving at profits for income tax purposes, any deductions in respect of capital charges, lost income or losses unconnected with the business. Provision is, however, made for a deduction from the statutory profits liable to tax of an allowance in respect of the depreciation of machinery or plant.

Computation of the Statutory Income.

Subject to certain exceptions, the statutory income liable to be taxed for any year of assessment (a year running from April 6 to the following April 5) is—in the case of the variable incomes derived from trades, manufactures, professions and employments (except those of wage earners), and also in the case of income from investments (other than property in the United Kingdom) received without deduction of tax—the actual income of the preceding year. In the case of business profits, the trading year usually replaces the fiscal year. Income from property (schedule A), from the occupa tion of lands (schedule B), from interest on public funds (sched ule C), from wages, and all income taxed by deduction under the principle of collection at the source (vide Collection of the Tax) is computed, when ascertaining the statutory income of the year of assessment, at the amount of the income assessed for, or earned, or taxed by deduction (as the case may be) in that year.

Computation of the Tax.

For the year 1928-29 income tax is charged at a standard rate, and, in the case of an indi vidual whose income exceeds £2,000, at a rate or rates exceeding the standard rate in respect of fixed sections of income above that amount. For 1927-28, the scale of these rates, known up to 1927 28 as rates of super-tax, but after that year as rates of surtax, is set out under rates and yield of tax.

Differentiation.

This is the principle of granting a relief from the full weight of the tax on earned income. Introduced in 1907, by means of a reduction of the normal rate of income tax, and changed in 192o to the method of deducting from the earned income of an allowance of part of that income, subject to a maxi mum, the method in force from 1928-29 is as follows. From the tax computed at the standard rate is deducted an allowance of tax, at that rate, on one-sixth of the amount of the earned in come, subject to a maximum deduction of the tax on £250.

Graduation.

This is the principle of charging a heavier rate of tax upon large incomes than upon small. From the inception of the tax, graduation in some form or other has been among its char acteristics. From 1920-21 to 1927-28 inclusive, after deducting from the total of the statutory income from various sources the allowance in respect of earned income (vide Differentia tion), there was deducted from the balance, called the assess able income, an aggregate of various personal allowances and deductions (e.g., for self or self and wife, children, house keeper, dependant relatives, etc.), leaving a balance called the taxable income. The first £2 2 5 of this taxable income was charged at half the standard rate, and the balance, if any, at the full standard rate. From 1928, the reliefs are granted in terms of tax, instead of in terms of income. In other words, from the total tax calculated at the standard rate on the aggregate statutory income is deducted tax, calculated at the standard rate, on the personal allowances and deductions. Further deductions of tax are made of (a) half the tax remaining chargeable, or half the tax at the standard rate on £225, whichever is the less, and (b) tax at certain defined rates on the amount of life insurance premiums, within fixed limits, and on the amount of income which has already borne dominion income tax.If the system of graduation stopped at this point, the relevant curve would rise steeply until incomes in the neighbourhood of £2,000 were reached, but after that point it would flatten rapidly. To continue the graduation, rates of sur-tax (before 1928-29 the name was super-tax) are charged on sections of income above £2,000 in the case of individuals. Sur-tax is expressed to be a deferred instalment of income tax. It is normally payable on or before Jan. 1 following the end of the year of assessment for which it is payable. For administrative reasons, sur-tax is as sessed and collected, under the aegis of the special commissioners of income tax, separately from the income tax. The effect of this system as a whole is to levy an effective rate of tax on each £ of the total statutory income of an individual, rising gradually from a fraction of a penny in the £ until the rate closely approaches a maximum rate represented by the sum of the standard rate of income tax and the highest rate of sur-tax.

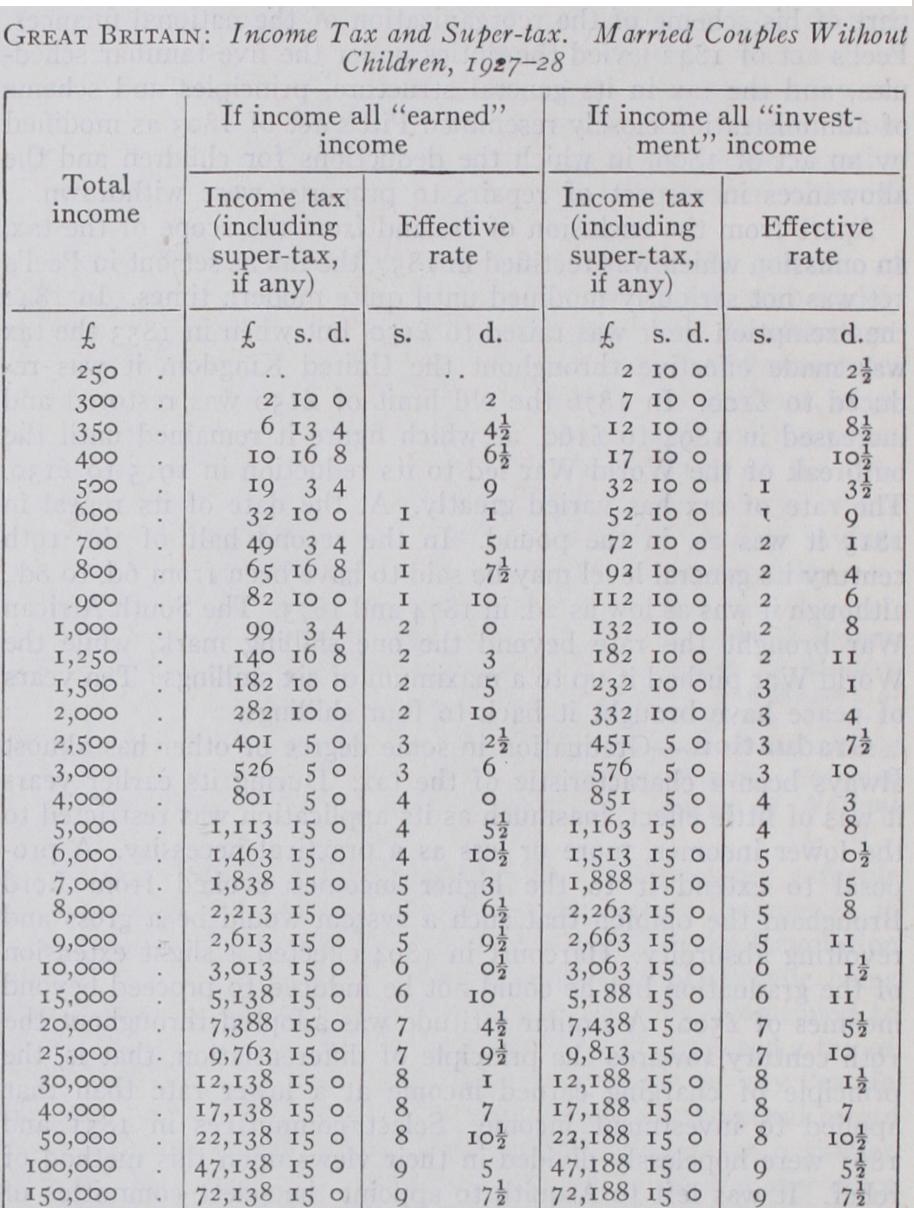

The following table of the amount of income tax and super tax and the effective rate of tax per £ of income on specimen in comes clearly illustrates the graduation of the tax in the case of married couples without children for the year 1927-28. It shows how the effective rate rises in the case of earned income from 2d. in the £ for a total income of £30o by gradual stages up to 9s. 7 d. in the £ on an earned income of £i5o,000. The rate for investment income rises from 23d. for an income of £25o to 9s. 7 2d. for one of £ 15o,000. Plotted on a graph, these effective rates fall upon a very smooth line unbroken by any abrupt jumps.

Collection at the Source.

Perhaps the most famous char acteristic of the British tax is the principle of collection at the source. Under this principle the tax is obtained, whenever it is possible to do so, by deducting it before the income reaches the person to whom it belongs. The formal assessment is accord ingly laid, wherever this course is possible, on each source of income by itself and on persons who are debtors in respect of income belonging to other persons. Power is given to the payer of income to deduct the appropriate tax from the payments made to the ultimate proprietors of that income. For instance, a limited liability company is assessed to tax at the standard rate on the whole of its profits, without reference to their ultimate destination. On paying interest to its debenture holders, or divi dends to its shareholders, the company is entitled to deduct and retain tax at the standard rate on the interest paid or dividends distributed, and the investor thus receives his interest or dividend subject to this deduction of tax. It is estimated that approxi mately two-thirds of the net yield of the tax is collected at the source.With the exception of tax collected at the source on interest on public debts, and on income from foreign dividends, etc., which is paid at or shortly after the time of payment of the in come from which the tax is deducted, income tax contained in the main assessments for the year is due and payable on or before Jan. i in the year of assessment; tax contained in additional ' assessments signed after that date is payable on the day after the date of signature. To this general rule there are, however, some other important exceptions. The tax charged on any indi vidual or firm in respect of lands occupied for husbandry, or in respect of a trade, profession or vocation, and of most employ ments, is payable in two equal instalments, the first on or before Jan. i in the year of assessment and the second on or before the following July 1. Manual wage earners assessed half-yearly pay tax in respect of each half-year. Tax in respect of employments under the Crown is deducted (usually quarterly) at the source.

Administration.

The responsibility for assessment and col lection of a very large part of the tax is laid upon local bodies of commissioners possessing certain property or other qualifica tions, which are appointed for certain cities and boroughs and for parts or all of a geographical county. The commissioners are independent of official control; they appoint their clerk, and (ex cept in respect of certain areas or functions) assessors of taxes and collectors of taxes; on them falls the statutory duty of sign ing and allowing assessments made either by the assessor or the additional commissioners (the name given to those who make assessments on trade profits) and of hearing and determining appeals against such assessments. Fitted into this scheme is the officer of the Crown, known as H.M. inspector of taxes. In law his part is primarily to safeguard the interests of the revenue with strictly defined rights of intervention and objection at vari ous stages of the formal procedure laid down by the statutes.This broad scheme is honeycombed with exceptions. There are the special commissioners of income tax, each of whom, still in dependent of the revenue authority, is appointed by the Treasury. Then there are commissioners for the various public departments of State. The Bank of England and the National Debt Commis sioners also act as commissioners. Again, all assessments on man ual weekly wage earners which are for a half year only are made by H.M. inspector of taxes. The taxpayer normally charged by the district commissioners may, if he wishes, elect to be dealt with by the special commissioners, and even if he allows his as sessment to be made by the district commissioners he may take an appeal against that assessment to the special commissioners.

During the past 5o years income tax has grown so much in im portance and complexity that its efficient administration has com pelled a considerable development of the methods of administra tion. In practice, the inspector of taxes carries out, with the full concurrence of the various bodies of commissioners, most of the duties that are vitally essential to the smooth-working efficiency of the machinery of administration. Nevertheless, the key func tions of the district commissioners have been preserved through out. In the absence of any detailed accounts or other evidence, it is the additional commissioners who determine the amount of the assessment upon business profits ; even more important, the general commissioners retain their appellate functions and so stand in an independent and impartial position between the tax payer and the representative of the revenue.

Rates and Yield of Tax.

In 1920-21 a new system of dif ferentiation and graduation was introduced in accordance with the recommendations of the Royal Commission on the Income Tax of 192o. In 1927-28 the effective exemption limit was of assessable income, or £162 in terms of earned income. For married persons these figures change to 1225 and 1270. The total number of individuals within the scope of the tax in 1925-26 was estimated at 4,600,00o.The standard rate of tax for the three years 1925-26 to 1927 a8 was four shillings in the pound. For 1925-26 the total statu tory income of persons liable to the tax for the new United King dom of Great Britain and Northern Ireland was estimated at £2,375,000,000. In 1926-27 the Exchequer receipt was 717,000 and it was estimated that the collection in 1927-28 would amount to 1247,000,00o.

The preceding figures relate to income tax alone and do not include the yield of the super-tax. The point at which liability to this tax commences is £2,000. The scale of rates of tax in force since 1925-26 is given below. In 1925-26 the number of indi Taxation according to faculty, that is, direct taxation, based upon the principle of ability to pay, so early established in Great Britain, was naturally carried overseas to the various British pos sessions. It is not therefore surprising to find income taxes firmly established to-day in South Africa, in the provinces and pro tectorates there as well as in the Union, in Canada, where also there are provincial income taxes as well as the Dominion tax, Australia, where a similar widespread use of the tax is made, New Zealand, India and in most of the West Indies. Naturally also there is a strong family resemblance between the various in come tax systems, most of them having been strongly influenced by British law. Income is usually defined broadly but com prehensively, but there is a general absence of the schedular arrangement of the British tax. Broadly speaking, the year pre ceding the year of assessment is favoured as the basis of compu tation of the income to be charged. The minimum amount of income exempted from tax varies, but personal allowances to the taxpayer, his wife and children are general. Graduation of the tax is a common feature, and the device of an additional tax, or super-tax, is freely adopted. In some dominions, gradua tion is extended also to companies. The methods of graduation range from simplicity to formulae of great complexity. Differ entiation in favour of earned income is found, but is not widely favoured. Taxation at the source is a frequent feature, especially in respect of dividends paid by companies. The rates of tax vary widely, as may be expected from the range of budget re quirements of communities of different populations and varying degrees of wealth. As a rule, the income tax in the British dominions overseas is one tax levied upon the base of the total income, irrespective of the nature of the components of that income. In this respect, the British tradition is followed.

BIBLIOGRAPHY.--J. C. Stamp, British Incomes and Property (1916) ; Bibliography.--J. C. Stamp, British Incomes and Property (1916) ; S. Dowell, The Acts Relating to the Income Tax (9th ed., rev. P. M. Smyth, 1926) ; E. R. A. Seligman, Public Finance (1926). See also "Report of Departmental Committee on the Income Tax," with Appendix, Cmd. 2,575 and 2,576 (5 905) ; "Report of the Select Committee on the Income Tax," no. 365 (1906) ; "Report of Royal Commission on the Income Tax," Cmd. 615 (192o) ; "Finance Act," pt. 2, Income Tax (1925) ; Commissioners of Inland Revenue (Annual Reports) ; "Financial Statements presented to the House of Commons by the Chancellor of the Exchequer" (Annual) .