Protection Free Trade

FREE TRADE, PROTECTION, and SAFEGUARDING OF INDUSTRY.) Customs Tariffs of the United Kingdom (Blue Book G 8706 of 1897), is the best detailed account of customs history to that date ; for the years after 1897 it is necessary to consult the Statistical Abstract of the United Kingdom, and the lists published by the British Stationery Office under the safeguarding of industries act.

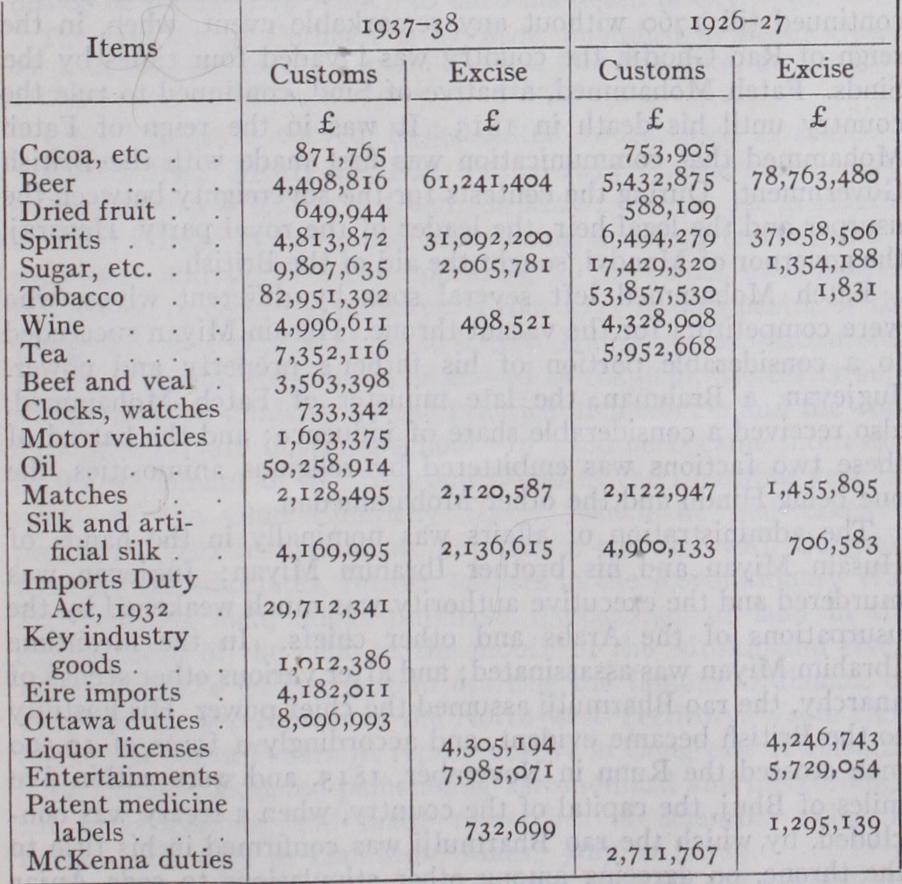

The chief heads under which these duties are imposed in Great Britain are: oil, spirits, beer, tobacco, tea, sugar, wine, silk and artificial silk, cocoa, matches, beef and veal, motor vehicles, enter tainments and liquor and other licences. Spirits, beer, artificial silk, sugar, matches and mechanical lighters are subject to both customs and excise duties. Tobacco, tea, silk, cocoa, oil, beef and veal, and clocks are subject to customs duties only. Entertain ments are subject only to excise duties.

The yield from the combined customs and excise duties was as follows: 1913-14, L75,226,538; 1917-18, f Io9,467,421; 1918-19, f 163,129,231; 1919-2o, f 283,335.635; 192o-21, L333,813,420; 1921-22, L323,354,993; 1922-23 (in and after which year the figures apply to Great Britain and Northern Ireland, the Irish Free State having come into existence), f ; f 1 ; 1925-26, f ; L286,884,014; 1937-38, L336,116,854.

Customs or import duties in the United States are collected at certain specified ports of entry according to the schedules of the tariff act then in effect (see TARIFFS). However, according to the Tariff Act of 1922, the president may alter rates of duty by proclamation whenever, upon investigation, it is found that the duties fixed in the act do not equalize the differences in the costs of production of articles that are the growth or product of the United States, and of like or similar articles the growth or product of competing foreign countries. The right to change any rate or duty is restricted to a total increase or decrease of 5o% of the rate specified in the act. Customs in the United States are confined to imports only, as the Constitution prohibits both export and inter-State duties. Some rates are specific, i.e., based upon count, volume or weight irrespective of value; while others are ad valorem, i.e., based upon value alone. The imports of the United States for the calendar year 1926 were valued at $4,408,076,000, of which $1,499,969,00o worth were dutiable, as sessed $590,045,o0o or an ad valorem of 39.34%• The world wide depression cut these figures by 1933 to: imports dutiable $529,466,000, duty $283,681,000, equalling an ad valorem of In 1937 imports were $3,084,061.000. The actual customs col lections reported for years ending June 3o fell from the all time peak of $6o5,5oo,000 in 1926-27 to $25o,75o,000 in 1932-33. In the amount was Customs claims for the return of money illegally exacted by the administrative customs official are brought before the U.S. customs court. If the valuation by the local appraiser of im ported merchandise upon which an ad valorem duty is assessed is disputed by the importer he may appeal for revaluation within ten days after the personal delivery or mailing of the written notice of appraisement by the local appraiser. If the importer is dissatisfied with the classification by the collector of customs at the port of entry, he may file a protest in writing within 6o days with such collector, who thereupon must forward the papers to the court, and the case is regularly docketed. There are within the United States and its Territories 47 customs districts, and, at I I of these, regular dockets for the trial of such cases are held.