Dollar Stabilization

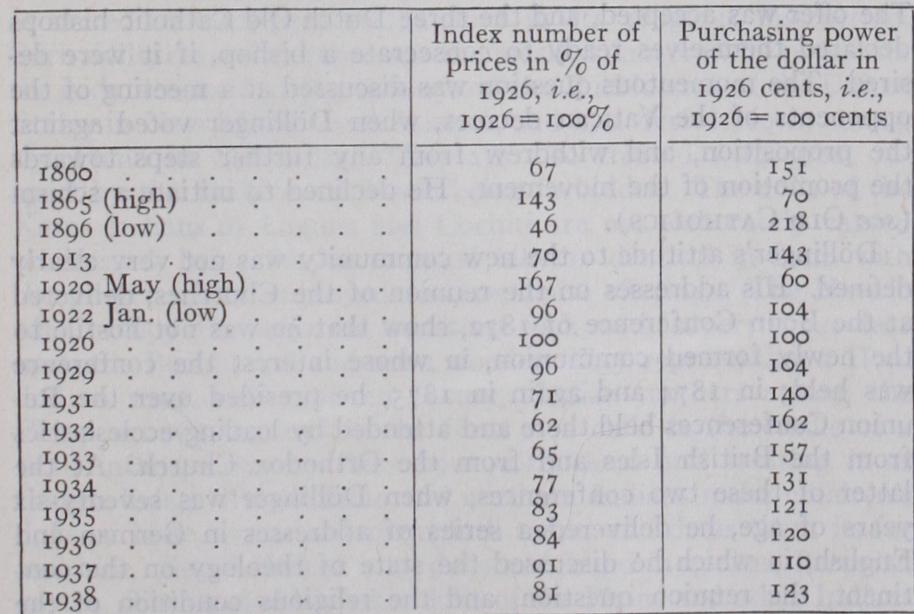

DOLLAR STABILIZATION. Under the existing currency system, the so-called "level of prices" is largely at the mercy of monetary and credit conditions. The purchasing power of money has, in the past, always been unstable, because a unit of money was not determined as a unit of purchasing power but only as a unit containing a certain weight of gold or silver. Other units— the yard, pound, bushel, etc.—were once as unstable as monetary units, but, one after another, they have all been stabilized or standardized. Short weights and measures cheat the buyer; long weights, the seller. So a unit of money which changes in value or purchasing power is always playing havoc between contracting parties. The following table shows how the level of prices and the purchasing power of the dollar have fluctuated, according to Prof. Irving Fisher's index number of wholesale prices.

An Unsatisfactory System.

When prices are rising, i.e., when the purchasing power of the dollar is falling, creditors and recipients of fixed incomes suffer injustice. The sufferers include savings-bank depositors, bondholders and salaried classes. On the other hand, when prices fall, it is other classes, such as debt ors, stockholders, farmers and independent business men gen erally, who suffer. The indirect effects of falling or rising prices, i.e., of a rising or falling dollar, are equally bad. These indirect effects include industrial discontent, due either to the high cost of living or to unemployment and economic crises.Hitherto there was ample excuse for the unstable monetary units of various countries, in that no instrument for measuring their aberrations had been devised. Likewise, until weighing scales were invented weights could not be standardized, and until instru ments for measuring electrical magnitudes were invented, elec trical units could not be standardized. But for some years the index number of prices has provided a fairly accurate instrument for measuring the value of money in terms of its power to purchase goods. An index number of prices is a figure which shows, for a specific period of time or on a specific date, the aver age percentage increase or decrease of prices. This instrument for measuring changes in the purchasing power of money has been utilized, beginning in the 192os, in adjusting wages and salaries to the cost of living, and a number of industrial and financial concerns, and some private agencies, have amended wages on the basis of an index number of the prices of commodities. A number of countries had also officially adopted the principle of adjusting a basic rate of the wages of labour in accordance with changes in the purchasing power of the monetary unit as expressed in an index number of the cost of living.

However, this method of offsetting fluctuations in the purchas ing power of money has proved entirely inadequate; for it merely intended to prevent some of the symptoms of monetary instabil ity, without attacking its cause. Since 1931 efforts have been made to incorporate the necessary corrections in the monetary unit itself by keeping it stable in purchasing power.

Trend Since 1931.

In 1929-3o, as prices began to decline, practically all currencies were linked to one another by the fact that they could, either directly or indirectly, be exchanged into fixed weights of gold. The fall of prices, therefore, indicated not only that national currencies were increasing in purchasing power, but that the value of gold was changing correspondingly. Coun tries whose currencies were not thus linked to gold, as for instance China which was on a silver basis, experienced no corresponding change in purchasing power and consequently no depression. In Sept. 1931, England, followed by the countries belonging to the sterling area, cut loose from gold and thus prevented any further appreciation of purchasing power. The fact that these currencies were no longer exchangeable into fixed weights of gold, caused fears of a repetition of post-war experiences with paper money, namely, a chaotic rise of prices indicating complete col lapse of purchasing power. In order to mitigate such fears and give direction to their monetary policies, the Scandinavian coun tries, notably Sweden, announced their determination to maintain the stability of purchasing power of their currencies as measured by an official price index. On July 3, President Roosevelt, in a message to the World Economic Conference then meeting in London, proclaimed a similar policy of dollar stabilization, saying that "the United States seeks the kind of dollar which a generation hence will have the same purchasing and debt-paying power as the dollar value we hope to attain in the near future." Requirements of a Stabilization Policy.—Experience has shown that the declaration of a policy of stable money, or the con struction of an official index number for measuring purchasing power, are not sufficient to actually maintain stability. Once a country has decided on purchasing power stability as the objective of monetary policy, it is essential that this goal be defined as narrowly as possible to eliminate the need for wide discretion on the part of the monetary authority—usually the central bank. Among the powers the monetary authority should possess is that of issue and control of the nation's money. This implies the need for banking reform so as to prevent commercial banks from arbitrarily changing the volume of money when lending their cus tomers not actual currency but the bank's credit. The practice of banks to issue their own credit when making loans, and de stroying this credit when calling loans, has been one of the chief factors responsible for violent fluctuations in the purchasing power of money. In the United States, such bank-created-and destroyed credit (called demand bank deposits) transacts more than nine-tenths of the nation's business. The monetary authority should also be required to change foreign exchange rates and the prices of gold and silver whenever necessary to maintain the stability of purchasing power of the monetary unit.BIBLIOGRAPHY.—J. M. Keynes, A Treatise on Money (193o) ; R. Bibliography.—J. M. Keynes, A Treatise on Money (193o) ; R. Eisler, Stable Money (1932) ; T. Greidanus, The Value of Money (1932) ; B. P. Blackett, Planned Money (1932) ; G. F. Warren and F. Pearson, Prices (1932) ; I. Fisher, Stable Money (1934) ; A. D. Gayer, Monetary Policy and Economic Stabilization ; G. Cassel, The Downfall of the Gold Standard (1936) ; I. Fisher, e000 Money (1936) ; J. W. Angell, M. Eccles, A. Hansen, R. G. Hawtrey, E. Lindahl, B. Ohlin, J. H. Rogers and is others, The Lessons of Mone tary Experience (I. F.)