The Federal Budget Fiscal 1959

Total appropriations and other forms of new obligational authority recommended for the fiscal year 1959 amount to $72.5 billion. This is $4.7 billion more than has been enacted for 1958 and $2.3 billion more than for 1957. In addition, $6.6 billion of supplemental authorizations are estimated for the current year, 1958, for the Department of Defense, Commodity Credit Corporation, Export-Import Bank, and other agencies.

Budget expenditures in the fiscal year 1959 are estimated to be $73.9 billion. This is $1.1 billion more than now estimated for 1958 and $4.5 billion more than in 1957.

Not all of the obligational authority enacted for a fiscal year is spent in the same year. Amounts of authority enacted in prior years but which have not yet been spent and are carried forward from one fiscal year to the next are called unexpended balances. These balances are not cash on hand, but represent authority to draw on future receipts of the Treasury in order to pay bills.

The total balances of appropriations to be carried forward at the end of the fiscal year 1959 are estimated to be $39.9 billion. Of this amount 78% will have been obligated; that is, already committed.

The largest part of the unexpended balances of appropriations is in the Department of Defense, reflecting the long time which necessarily elapses between the placing of orders for complex military equipment and delivery and final payment. It is estimated that $32.1 billion will be carried forward by that Department at the end of 1959, of which $24.4 billion will have been obligated.

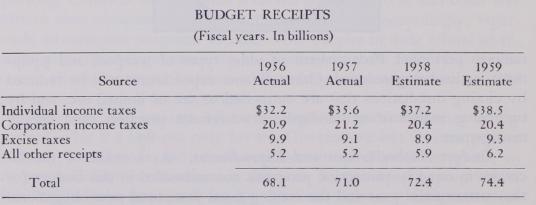

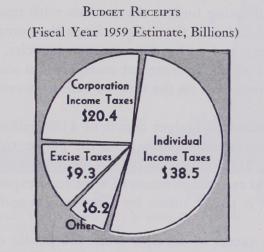

Budget Receipts. Although higher than in previous years, the current estimate of receipts for the fiscal year 1958 is somewhat smaller than earlier expectations, reflecting readjustments currently taking place in our economy following the rapid growth of the past several years. It now appears that 1958 budget receipts will not exceed $72.4 billion, although they will be well above 1957 receipts of $71 billion. A combination of increased defense expenditures and decreased receipts in the revised estimates for the current fiscal year results in an estimated budget deficit of $0.4 billion.

There are strong grounds to support my confidence that the expansion of our economy will soon be resumed, bringing higher levels of receipts with present tax rates. The acceleration of defense efforts al

ready under way, the increasing pace of activity in a number of programs involving State and local as well as Federal expenditures, the rapid pace of technological advance and its application by American industry, the expanding needs and desires of our growing population, and Government policies designed to facilitate the resumption of growth are among the major factors that justify this confidence. While there are many uncertainties in forecasting results 18 months in advance, our best estimate at this time of budget receipts for 1959 is $74.4 billion. This would produce a balanced budget with a surplus of $0.5 billion in 1959.

With relatively minor exceptions, present tax rates have not been changed since 1954 when a program of tax reduction and reform was enacted, saving taxpayers nearly $7.5 billion annually. If the Congress follows my recommendations, I believe that we shall be able to do what is required for our defense efforts and meet the basic needs of our domestic programs without an increase in tax rates. To maintain present rates, I recommend that tax rates on corporation income and certain excises, which under existing law are scheduled for reduction next July 1, be extended for another year.

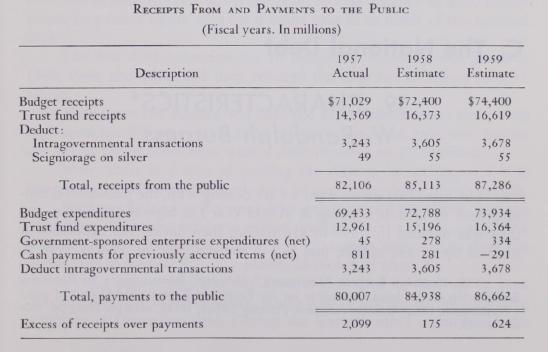

A measure of the impact of Federal transactions on the economy is obtained by consolidating budget transactions with trust fund and other transactions not included in the budget. Since the consolidation excludes transactions between and within Government agencies, and also excludes noncash accruals, Federal Government receipts from and payments to the public present information on the flow of cash between the Government and the public.

Despite an estimated budget deficit of $388 million for the current year, Federal Government receipts from the public are estimated to exceed payments by $175 million in 1958. This reflects continued accumulations of trust fund receipts in excess of trust fund expenditures, although this accumulation is partly offset by Government-sponsored enterprise expenditures.

In 1959, the excess of receipts from the public over payments to the public is estimated to be $624 million, or $158 million more than the anticipated budget surplus.