The National Debt Characteristics

But part of it is due to good, solid causes, the growth of production and the expansion of the economy.

There is one thought— Senator DOUGLAS. Mr. Chairman, is Dr. Burgess including in his analysis—would it be appropriate if I asked a question at this time? Senator FLANDERS. Yes, you may do so.

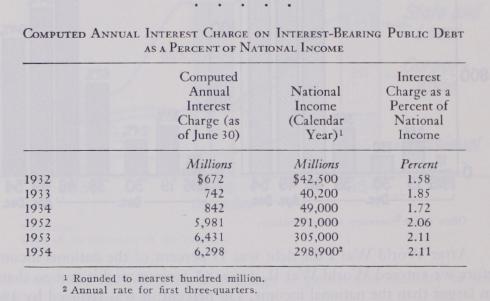

Senator DOUGLAS. The question I wanted to ask is this: If you take the carrying charges on the national debt as a percentage of national income, isn't the showing still more favorable because what we have had has been, until very recently, a very sharp fall in interest rates? I made some computations indicating that as a percentage of national income the interest on the national debt in 1933 was a larger percentage than it was in 1952.

Mr. BURGESS. Yes, we have those figures. The interest rates now, for example, are actually lower, the rate of interest is lower, than it was 2 years ago, so that— Senator DOUGLAS. I think as a percentage of national income, the cost of the national debt to the community was lower in 1952 than it had been in 1933, because roughly you have had a fall from 4 percent to 2 percent.

Mr. BURGESS. Yes, those figures are in the right area, Senator; I will have the figures inserted in the record.

There were two major problems of debt management that we faced. One was to do exactly what the Secretary indicated, to adjust our debt management to the business situation, and to the monetary policy, and the other was gradually over a period to lengthen out the debt so it would not be so heavily concentrated in short-term maturities.

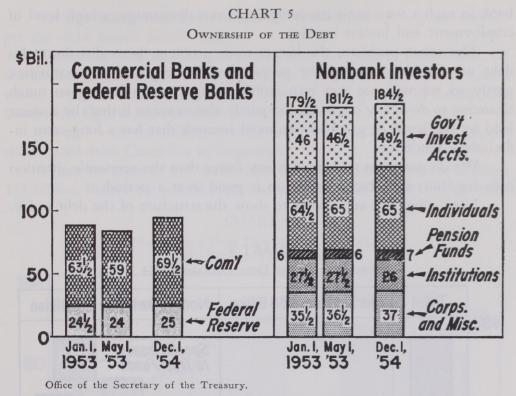

Now, the first job with the volume of money rising, and with an inflationary situation in the early months of 1953, was to see that our debt operations did not add to the volume of bank credit, that is, that our securities were sold as largely as possible outside the banks; and chart 5 shows that from January 1 to May 1, 1953, bank holdings of governments showed a decline rather than an increase. The Federal Reserve holdings also were down a little.

Then after the change in policy, commercial bank holdings of securities went up; the volume of money increased in accordance with what you would call a classical pattern. It no longer was so important for

us to concentrate on selling outside the banks, but on the contrary, some increase in the volume of bank credit was a desirable thing for the economy.

Now, the right-hand side shows the absorption of Government securities by nonbank investors. The corporations and miscellaneous group increased their holdings slightly throughout the period; nonbank institutions, which means insurance companies and savings banks, and so on, decreased their Government holdings over this period, as compared with no change during early 1953. That was in a way a beneficial thing because they were putting the money in mortgages and in industrial securities and in other investments which created employment and offset the recessionary tendencies of the period.

Pension funds held $6 billion of Government securities in that period, and they now hold $7 billion, when those figures are rounded off; that is a steadily growing market for Government securities.

Individuals have increased their holdings slightly, and that is where our savings-bond program comes in, which is a long-term program for getting individuals to buy Government securities, and getting a wide distribution of the debt.

Another steady absorption of the debt outside the banks is in the trust funds of the Federal Government—social security, unemployment funds, and so on—and that has increased over this period of 2 years by $3% billion.

In a way, it is a kind of funding of the debt although it is, of course, on call if there is heavy unemployment or other economic situations that may lead to a more rapid withdrawal of social-security funds.

• • • • • Now, a few words about the other phase of our financing.

The first and most important phase is to adjust our debt management policy to the business situation and to the policies of the central bank in such a way as to encourage, and not discourage, a high level of employment and honest money.