The National Debt Characteristics

The other problem, the longer-term problem, is to distribute this debt more widely among the people, and to lengthen the maturities, partly so we will not run into embarrassing jams in having so much financing to do in any one year, and partly also to see to it that the amount held by the banks is gradually reduced because that has a long-term inflationary tendency.

We do not want to reduce it any faster than the economic situation calls for, but some bank reduction is good over a period.

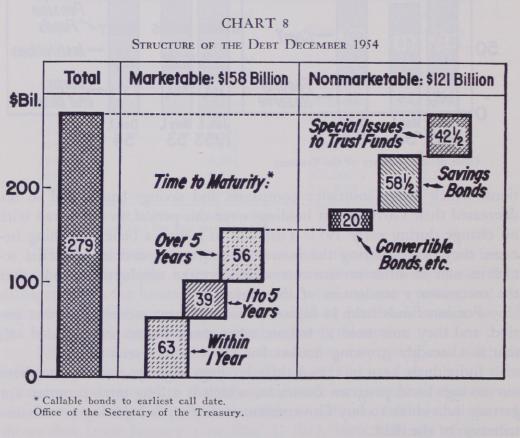

Now, chart 8 is an attempt to show the structure of the debt today.

The left-hand column is the total debt, and then a group of blocks are shown to represent the marketable debt of $158 billion. About $63 billion of that now matures within 1 year, and of that close to $20 billion is in the form of Treasury bills. About $39 billion matures in 1 to 5 years, and $56 billion in over 5 years. All callable bonds are considered to their first call date.

The other section of the debt is the nonmarketable debt and that amounts to $121 billion. Of that, $20 billion is convertible bonds, savings notes, and miscellaneous issues. About $12 billion of that is the 2% percent bonds which were used in refunding a great big indigestible lump of 2% percent marketable bonds in the spring of 1951.

Savings bonds total $58.5 billion. We think that is a good way tc get the debt better distributed.

Then there are the special issues to the Government trust funds. 01 the amount held by the Government trust funds, part is in special issues, which we issue directly from the Treasury, and part is in marketable bonds; the figures on the chart are the specials.

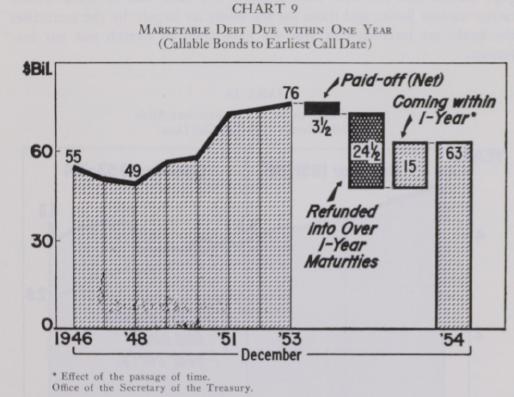

Now, I want to show you what we have been trying to do on the short-dated debt. Chart 9 is an illustration.

When we came in, the marketable debt due within 1 year was about $74 billion. Before we got through the calendar year of 1953, it had riserto $76 billion. We had not been able to do as much about it as we would have liked to because we faced, as you know, a deficit of $9.4 billion in 1953, and the credit situation was such that it was not desirable during the summer and early fall of 1913 to put any financing out other than short terms, so we up $76 billion.

Now, over the past year we have gradually reduced that $76 billion due ithin a year to $63 billion; $3.5 billion of debt vas paid off; $24.5

billion was refunded into issues longer than 1 year; most of that went to the banks, but it stretched out their maturity to put their holdings in more manageable form. Then, as an illustration that you have to run pretty fast in this business to stand still, $15 billion of debt issued in earlier years came within the 1-year total. It had been longer, and time had gone on, and it came within the 1-year period. That brings us out with $63 billion maturing within a year, which is a more manageable figure than at the end of 1953.

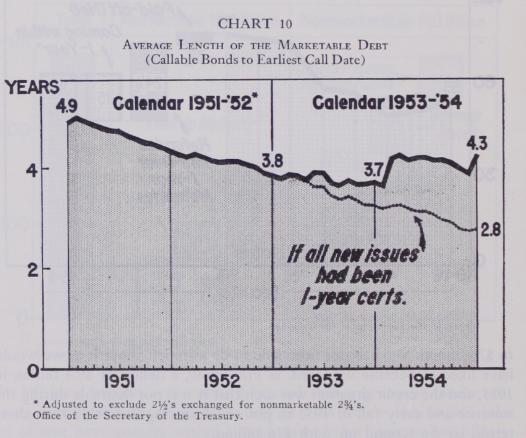

Now, another way of illustrating the change in the debt as to maturities is by figuring out the average length of the marketable debt.

As I say, there has been a period during the last 2 years when we had to temporize with this problem—when we could not go out and try to spread the maturities very vigorously.

We have been criticized for not putting out long bonds this year.

I think we were absolutely right in not doing so, because it would have been clearly in competition with the enormous loan funds in the mortgage market and the new issue market. We have had to work within rather narrow limits, and those are the limits set largely by the maturities the banks are interested in. But we have tried to stretch out our maturities.

Chart 10 shows the average length of the marketable debt, which was 4.9 years at the beginning of 1951. Then it went steadily down as the Treasury financed itself largely with short-term issues, so that at the beginning of 1953 it was 3.8 years. That is the average length of the entire marketable debt.

Now, as I have indicated before, in 1953 we did reasonably well just to hold even. We came out at the end of the year with about the same figures as at the beginning. This year we have been able to stretch out the debt somewhat in refundings, particularly in February and in our current December financing, so we will finish up the year with an average length of debt of about 4.3 years.

If we had refunded all the securities that matured during 1953 and 1954 in 1-year certificates, the average length of the whole marketable debt would have been only 2.8 years.