Personal Distribution - Income Distribution

How much shifting between income classes occurs? We cannot answer this with a precise figure. We do know that about four out of every ten spending units reported that their 1954 incomes were higher than their 1953 incomes, about two out of every ten reported that their 1954 incomes were lower than their 1953 incomes, and the remaining four out of ten reported that their incomes did not change significantly. We also know that about a half of those in the lowest-income class were in a higher-income class the year before and that about a fifth of those in the highestincome class had been a lower-income class the year before. This suggests that there is considerable shifting between income classes. Consider the reasons.

Shifting Due to Age and Family Formation or Dissolution

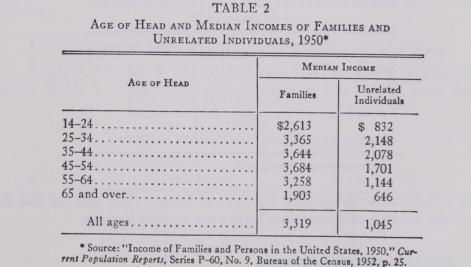

The first and probably the most important is that people are paid less when they are young, more in middle age, and less again when they retire. Your attention is directed to Table 2, showing the median incomes of families and unrelated individuals classified by age groups. (The median is the middle item in an array of items arranged by size.) You will note that the median income of families whose head was between fourteen and twenty-four years old was $2,613, while the median income of families whose head was between forty-five and fifty-four years old was about $1,000 more. The relationship was about the same for unrelated individuals, except the peak was in the 25-34 year group. Unrelated individuals, you will note, received much less income than families in all age brackets.

Shifting between income classes also occurs because of family formation and dissolution and changes in the number of earners in a family. Initially, let us suppose that two young people, John and Mary, are earning $1,500 each but are living at home. Their incomes will be added to the incomes of their parents, thus putting their families in the middle or upper-income classes. Then suppose that both John and Mary leave home. The incomes of their families will shrink and will appear in the lower part of the income distribution. If John and Mary are then married and Mary continues to work, a new family will be formed; their combined income may put them in the middle part of the income distribution. When Mary quits her job to raise a family, their income will fall, although by this time John may be earning more. In time their children may go to work and augment the family's income. Finally, when the children have left home and John is too old to work, their income is likely again to be small.

Also Due to Multiple Workers per Family

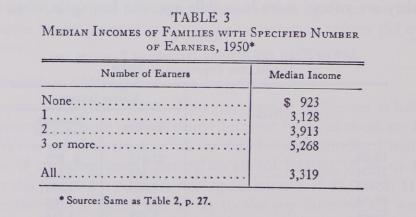

We know that family income is closely related to the number of earners in a family. Table 3 shows the median incomes of families and unrelated individuals with specified numbers of earners. You will see that the larger the number of earners the higher the median income.

And to Fluctuating Incomes

Some incomes show more year-to-year variations than others. Salaried workers' incomes are fairly steady. Workers employed in the construction trades are likely to have high incomes in some years and low incomes in others. Farmers, too, have fluctuating incomes. Heads of small businesses, real-estate brokers, salesmen dependent on commissions, and lawyers are likely in one year to be in the upper part of the income distribution and in the next in a lower part. Even if the average money incomes of all families over, say, a ten-year period were the same, the year-to-year distribution of income would show considerable inequality because of fluctuations in annual income.

And

to Part-Year Incomes The movement of workers in and out of the labor force also introduces a bias. People who work only part of a year, like college graduates who get jobs in July, are likely to show up in the lower part of the income distribution even though their annual rate of pay is quite high. Deaths during the year also account for the reporting of part-year incomes (and part-year incomes are likely to be near the bottom of the distribution). The labor force is constantly changing, with people entering and people leaving it. It has been estimated that during 1954 an average of 3 million persons entered the labor force each month and nearly as many left it, showing that there would be included in the distribution of incomes a considerable number of part-year incomes.

Shifting between income classes makes it difficult to interpret the annual distributions of income. To what extent do they reflect year-to-year changes in income due to such factors as (1) the age-income cycle, (2) family formation and dissolution and changes in the number of earners per family, (3) fluctuating incomes, and (4) the entry into and exodus of workers from the labor force? The answer is that we do not know. We do know that the factors are important. We know that even if lifetime incomes were equal, the annual distributions would show considerable inequality.