Personal Distribution - Income Distribution

The increase in income taxes, which take more out of the incomes of the rich than the poor, also has contributed to the shift toward greater equality. From 1929 to 1948 "the advance in taxes paid by the upper 1 per cent was sufficient to convert a rise of 21 per cent in per capita income before taxes to a decline of 9 per cent after taxes. Drastic though the changes were, the rise in income taxes accounted for no more than a fourth of the decline in inequality of income after taxes. Most of the decline was due to changes in factor prices and from one type of occupation to another. The wage rates of the lower-paid urban workers and farm workers rose more than the wage rates of the higher-paid workers and professional people from 1920 to 1948. Meanwhile interest rates and rents declined. The major part of the shift toward greater equality seems to have been due to the functioning of the price mechanism.

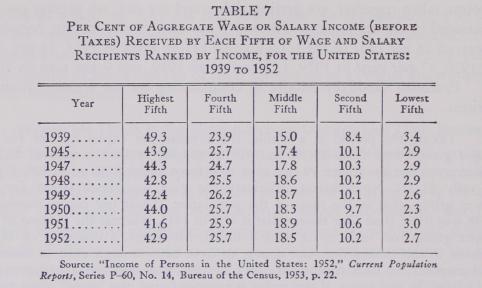

The recent figures showing the distribution of wage and salary income also support these conclusions. (See Table 7.) During the thirteenyear period 1939-1952 the share of the aggregate wage and salary income received by the upper fifth of the recipients declined from about 49 per cent to about 43 per cent. During the same period the middle three fifths of the recipients received a larger share of the total. The share received by the lowest fifth declined, indicating that the gain in equality during this period was due to a redistribution of income between the upper and middle income groups. And this is what we would expect, since we have already seen that poverty is largely due to the lack of earning power.

Conclusion We must conclude, then, that the uncorrected figures are grossly misleading. The nation's income is not as unequally distributed as the figures at first indicate. Moreover, recent studies have shown that the functioning of the economy over the last quarter of a century has tended to reduce inequalities in income. While there is still "poverty in the midst of plenty" in the United States, it tends to be due to specific causes, such as race prejudice, broken homes, disabled workers, unequal opportunities for female workers, and the immobility of farm workers, rather than to the alleged tendency in a capitalistic economy for the rich to become richer and the poor poorer.