Personal Distribution - Income Distribution

Governmental Benefits May Also Be Regressive, Proportional, or Progressive

Governmental benefits, too, may be classified as regressive, proportional, or progressive, depending on whether they go primarily to the lower- or higher-income groups. Benefits like free public schools, parks, welfare activities are regressive: they are larger in relation to the incomes of the lower-income groups. The benefits of the Securities and Exchange Commission are probably progressive: they are more useful to the upperincome groups.

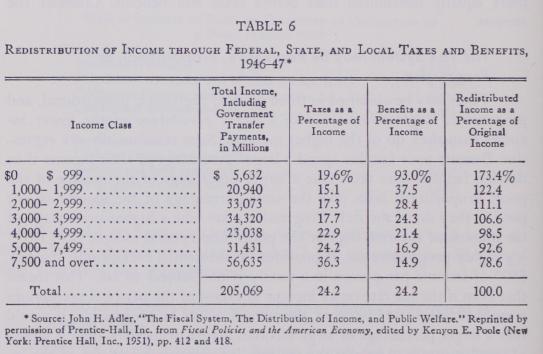

To appraise the way Federal, state, and local governments affect the distribution of income, we would have to consider the effect of both taxes and benefits on the various income classes. This is not easy to do. We would have to make estimates of the percentage of each tax—and there are many taxes—paid by each income class. Then we would have to consider the distribution of benefits—and there are many of them also—between income classes. Once we had allocated taxes and benefits we could make a new estimate of the real income going to each of the income classes. The available evidence suggests that the tax structure of the United States is progressive and that the benefit structure is regressive— so that on balance government appears to take from the rich and give to the poor. You are referred to Table 6 below, prepared by Dr. John H.

Adler for the fiscal year 1946-1947. While the estimates in this table are no doubt tentative, they indicate a considerable amount of redistribution via taxes and benefits. You will see that after taxes and benefits the lowestincome class would have about 75 per cent more income and the highestincome class about 20 per cent less.

Corrections Summarized

The corrections come then from (1) the year-to-year shifts between income classes as a result of the age-income cycle, family formation and dissolution, multiple workers, part-year workers, and so forth, (2) family size, (3) occupational costs, (4) costs of living, and (5) governmental taxes and benefits. They make it difficult to interpret the usual income-distribution statistics.

Who Are the American Poor?

Granted that the uncorrected figures are misleading and that the distribution of lifetime incomes after taxes would show much less inequality, is it not true that there is still "poverty in the midst of plenty"? The answer is probably, yes: there are many families (although we are not in a position to say how many) and single individuals whose average lifetime incomes are below $2,000 a year (to pick an arbitrary dividing line).Who are they? Are their low incomes due to the malfunctioning of the economy or are their low incomes due to other causes? Consider the groups whose average incomes are low.

1. Nonwhites. The average income of nonwhite families, largely Negro families, are much lower than the incomes of white families. In 1950 white families and individuals received a median income of $3,135 while nonwhite families and individuals received a median income of $1,569.

2. Broken Families. The incomes of broken families are lower than the incomes of normal families. In 1950 the median income of normal families was almost $3,500 while the median income of families headed by a woman, with the husband dead, disabled, or missing, was about $1,900. This means that over half of the 4 million broken families, whether due to death, divorce, desertion, or disability, had annual incomes of less than $2,000.

3. Disabled. It has been estimated that about 4.5 million persons, exclusive of the very young and the aged, are disabled at one time. Many are only temporarily out of the labor force, but between a third and a half are permanently unemployed. There are few data available to indicate their median incomes, but fragmentary information indicates that their incomes are much less than $2,000.

4. Unmarried Women. The incomes of women workers are much lower than those of men. When the husband and wife both work, the lower wage rate typically paid women does not lead to poverty. But in 1950 there were about 5 million women workers living alone. The median income of urban women workers between the ages of 35 and 45 was about $1,500 in 1950 compared to the median income of male workers of the same age of about $3,500.

5. Subsistence Farmers. There are large differences in the incomes of farm families. Those farmers using modern methods to till fertile soils have incomes well above the poverty level. But many families live on subsistence farms and earn only a meager living. In 1950, a fairly prosperous year, almost 2.5 million farm families, many of them large, had incomes of less than $1,500. Many were Negroes living on share-crop land in the South.